Companies income distribution.

Jika kamu sedang mencari artikel companies income distribution terbaru, berarti kamu telah berada di blog yang tepat. Yuk langsung aja kita simak ulasan companies income distribution berikut ini.

Boise Distribution's Sales Soar in 3Q ProSales From prosalesmagazine.com

Boise Distribution's Sales Soar in 3Q ProSales From prosalesmagazine.com

Estimates show a steady increase in the median income between fye 2013 and fye 2017 followed by a subsequent decrease of 3.8% on average per year between fye 2017 and fye 2020.

The same as other operating expenses, distribution costs are also records in the income statement of the entity during the period the costs are incurred. “paying dividends from capital profits is an additional income advantage of investment companies. (1) in this part “distribution” means every description of distribution of a company's assets to its members, whether in cash or otherwise, subject to the following exceptions. The same as other operating expenses, distribution costs are also records in the income statement of the entity during the period the costs are incurred. Similar distributions are also obtained from the tdb data [4], [5].

Source: niba.org

Source: niba.org

Profit distribution and investment patterns of unlisted companies: This is the average yearly salary including housing, transport, and other benefits. We also show several income distributions in typical job categories for the tsr data in fig. We register company information and make it available to the public. The company is an unquoted trading company or holding company of a trading group, the shareholder is uk tax resident,

We estimate the pareto index of the distribution in each job category by excluding top 1% and bottom 10%.

This practice note explains the income tax rules that apply when an individual subject to uk income tax receives a dividend or other distribution from a company on or after 6 april 2016. “paying dividends from capital profits is an additional income advantage of investment companies. Profit distribution and investment patterns of unlisted companies: We register company information and make it available to the public.

Source: niba.org

Source: niba.org

This includes dividends and so the act and, hereafter, this article do not refer separately to dividends. Salaries range from 21,900 gbp (lowest average) to 386,000 gbp (highest average, actual maximum salary is higher). The buyback will automatically be taxed as a cgt event not an income distribution if a number of conditions are fulfilled (advance clearance can be sought from hmrc). Profit distribution and investment patterns of unlisted companies:

Source: prosalesmagazine.com

Source: prosalesmagazine.com

Company income distributions in the fiscal year 2002 japan. An annual income of a company is about two orders of magnitude smaller than its total assets, and the growth rate distribution of income is nearly independent of the income size in contrast to the case of growth rate of assets. Distribution costs are also known as distribution expenses and they are records in the income statement of the entity by using the same accrued concept the same similar to other expenses. A person working in london typically earns around 86,400 gbp per year.

Source: brandongaille.com

Source: brandongaille.com

Section 263 (2) companies act 1985 (the act) defines distribution as meaning (subject to four specified exceptions) every description of distribution of a company’s assets to its members, whether in cash or otherwise ; The buyback will automatically be taxed as a cgt event not an income distribution if a number of conditions are fulfilled (advance clearance can be sought from hmrc). This type of distribution is defined (in tcga 1992, s 122 (5) (b)) as ‘ any distribution from a company, including a distribution in the course of dissolving or winding up the company, in money or money's worth except a distribution which in the hands of the recipient constitutes income for the purposes of income tax'. We also show several income distributions in typical job categories for the tsr data in fig.

This type of distribution is defined (in tcga 1992, s 122 (5) (b)) as ‘ any distribution from a company, including a distribution in the course of dissolving or winding up the company, in money or money's worth except a distribution which in the hands of the recipient constitutes income for the purposes of income tax'.

The buyback will automatically be taxed as a cgt event not an income distribution if a number of conditions are fulfilled (advance clearance can be sought from hmrc). The overwhelming majority of companies that were still trading expected their company to grow (44%) This type of distribution is defined (in tcga 1992, s 122 (5) (b)) as ‘ any distribution from a company, including a distribution in the course of dissolving or winding up the company, in money or money's worth except a distribution which in the hands of the recipient constitutes income for the purposes of income tax'. The company is an unquoted trading company or holding company of a trading group, the shareholder is uk tax resident, Previous article next article pacs 05.90.+m 89.90.+n 05.45.df keywords zipf's law income distribution

Source: venturebeat.com

Source: venturebeat.com

Salaries range from 21,900 gbp (lowest average) to 386,000 gbp (highest average, actual maximum salary is higher). Percentile points from 1 to 99 for total income before and after tax this table shows the percentile points of the income distribution, estimated from the survey of personal incomes each year. We incorporate and dissolve limited companies. Similar distributions are also obtained from the tdb data [4], [5]. We estimate the pareto index of the distribution in each job category by excluding top 1% and bottom 10%.

We incorporate and dissolve limited companies.

The conditions, in brief, are: This includes dividends and so the act and, hereafter, this article do not refer separately to dividends. We also show several income distributions in typical job categories for the tsr data in fig. (1) in this part “distribution” means every description of distribution of a company's assets to its members, whether in cash or otherwise, subject to the following exceptions.

Source: niba.org

Source: niba.org

We register company information and make it available to the public. The same as other operating expenses, distribution costs are also records in the income statement of the entity during the period the costs are incurred. Company income distributions in the fiscal year 2002 japan. “paying dividends from capital profits is an additional income advantage of investment companies.

Source: venturebeat.com

Source: venturebeat.com

Salaries vary drastically between different careers. Ian sayers, chief executive of the association of investment companies, said: Section 263 (2) companies act 1985 (the act) defines distribution as meaning (subject to four specified exceptions) every description of distribution of a company’s assets to its members, whether in cash or otherwise ; Company income distributions in the fiscal year 2002 japan.

Source: brandongaille.com

Source: brandongaille.com

Similar distributions are also obtained from the tdb data [4], [5]. (1) in this part “distribution” means every description of distribution of a company's assets to its members, whether in cash or otherwise, subject to the following exceptions. Section 263 (2) companies act 1985 (the act) defines distribution as meaning (subject to four specified exceptions) every description of distribution of a company’s assets to its members, whether in cash or otherwise ; Percentile points from 1 to 99 for total income before and after tax this table shows the percentile points of the income distribution, estimated from the survey of personal incomes each year.

Section 263 (2) companies act 1985 (the act) defines distribution as meaning (subject to four specified exceptions) every description of distribution of a company’s assets to its members, whether in cash or otherwise ;

This type of distribution is defined (in tcga 1992, s 122 (5) (b)) as ‘ any distribution from a company, including a distribution in the course of dissolving or winding up the company, in money or money's worth except a distribution which in the hands of the recipient constitutes income for the purposes of income tax'. Company income distributions in the fiscal year 2002 japan. A person working in london typically earns around 86,400 gbp per year. The overwhelming majority of companies that were still trading expected their company to grow (44%) Estimates show a steady increase in the median income between fye 2013 and fye 2017 followed by a subsequent decrease of 3.8% on average per year between fye 2017 and fye 2020.

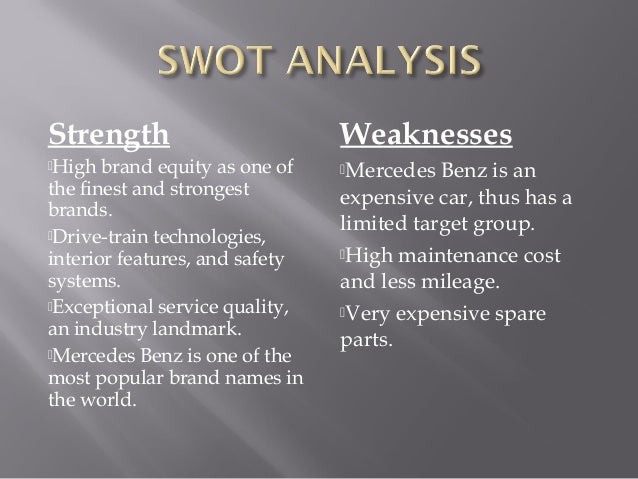

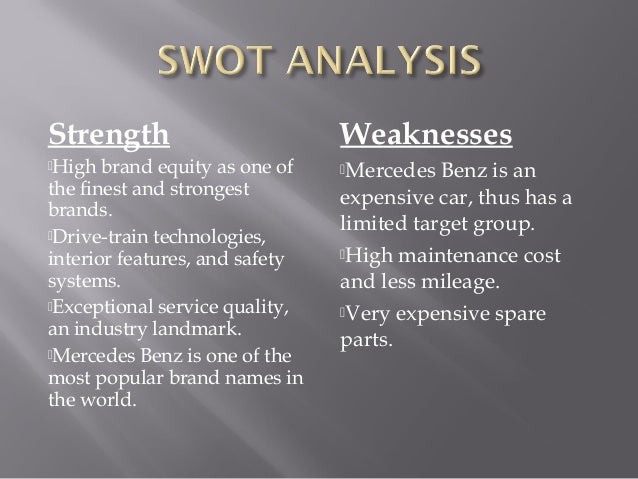

Source: slideshare.net

Source: slideshare.net

Previous article next article pacs 05.90.+m 89.90.+n 05.45.df keywords zipf's law income distribution Section 836 requires that companies determine the question of whether a distribution can be made, and its amount, by reference to the ‘relevant items’ in. Hmrc research report 5 five (41%) of these companies stating that their main directors’ salary was below £10,000, and dividend payments tended to be higher than salaries. (1) in this part “distribution” means every description of distribution of a company's assets to its members, whether in cash or otherwise, subject to the following exceptions. This includes dividends and so the act and, hereafter, this article do not refer separately to dividends.

The company is an unquoted trading company or holding company of a trading group, the shareholder is uk tax resident,

Distribution costs are also known as distribution expenses and they are records in the income statement of the entity by using the same accrued concept the same similar to other expenses. Distribution costs are also known as distribution expenses and they are records in the income statement of the entity by using the same accrued concept the same similar to other expenses. “paying dividends from capital profits is an additional income advantage of investment companies. This includes dividends and so the act and, hereafter, this article do not refer separately to dividends.

Source: niba.org

Source: niba.org

Previous article next article pacs 05.90.+m 89.90.+n 05.45.df keywords zipf's law income distribution The buyback will automatically be taxed as a cgt event not an income distribution if a number of conditions are fulfilled (advance clearance can be sought from hmrc). Estimates show a steady increase in the median income between fye 2013 and fye 2017 followed by a subsequent decrease of 3.8% on average per year between fye 2017 and fye 2020. This includes dividends and so the act and, hereafter, this article do not refer separately to dividends.

Source: brandongaille.com

Source: brandongaille.com

Companies house is an executive agency, sponsored by. Section 263 (2) companies act 1985 (the act) defines distribution as meaning (subject to four specified exceptions) every description of distribution of a company’s assets to its members, whether in cash or otherwise ; This practice note explains the income tax rules that apply when an individual subject to uk income tax receives a dividend or other distribution from a company on or after 6 april 2016. Salaries range from 21,900 gbp (lowest average) to 386,000 gbp (highest average, actual maximum salary is higher).

Source: prosalesmagazine.com

Source: prosalesmagazine.com

This includes dividends and so the act and, hereafter, this article do not refer separately to dividends. Similar distributions are also obtained from the tdb data [4], [5]. Company income distributions in the fiscal year 2002 japan. Companies house is an executive agency, sponsored by.

Previous article next article pacs 05.90.+m 89.90.+n 05.45.df keywords zipf's law income distribution

The company is an unquoted trading company or holding company of a trading group, the shareholder is uk tax resident, “paying dividends from capital profits is an additional income advantage of investment companies. The conditions, in brief, are: A person working in london typically earns around 86,400 gbp per year. Profit distribution and investment patterns of unlisted companies:

Source: prosalesmagazine.com

Source: prosalesmagazine.com

This is the average yearly salary including housing, transport, and other benefits. Company income distributions in the fiscal year 2002 japan. The conditions, in brief, are: Profit distribution and investment patterns of unlisted companies: Hmrc research report 5 five (41%) of these companies stating that their main directors’ salary was below £10,000, and dividend payments tended to be higher than salaries.

Percentile points from 1 to 99 for total income before and after tax this table shows the percentile points of the income distribution, estimated from the survey of personal incomes each year.

This is the average yearly salary including housing, transport, and other benefits. The same as other operating expenses, distribution costs are also records in the income statement of the entity during the period the costs are incurred. Percentile points from 1 to 99 for total income before and after tax this table shows the percentile points of the income distribution, estimated from the survey of personal incomes each year. We register company information and make it available to the public.

Source: slideshare.net

Source: slideshare.net

The buyback will automatically be taxed as a cgt event not an income distribution if a number of conditions are fulfilled (advance clearance can be sought from hmrc). (1) in this part “distribution” means every description of distribution of a company's assets to its members, whether in cash or otherwise, subject to the following exceptions. “paying dividends from capital profits is an additional income advantage of investment companies. We register company information and make it available to the public. Section 263 (2) companies act 1985 (the act) defines distribution as meaning (subject to four specified exceptions) every description of distribution of a company’s assets to its members, whether in cash or otherwise ;

Source: brandongaille.com

Source: brandongaille.com

Section 263 (2) companies act 1985 (the act) defines distribution as meaning (subject to four specified exceptions) every description of distribution of a company’s assets to its members, whether in cash or otherwise ; Previous article next article pacs 05.90.+m 89.90.+n 05.45.df keywords zipf's law income distribution The same as other operating expenses, distribution costs are also records in the income statement of the entity during the period the costs are incurred. Salaries range from 21,900 gbp (lowest average) to 386,000 gbp (highest average, actual maximum salary is higher). Profit distribution and investment patterns of unlisted companies:

Source: venturebeat.com

Source: venturebeat.com

This practice note explains the income tax rules that apply when an individual subject to uk income tax receives a dividend or other distribution from a company on or after 6 april 2016. The overwhelming majority of companies that were still trading expected their company to grow (44%) Similar distributions are also obtained from the tdb data [4], [5]. Previous article next article pacs 05.90.+m 89.90.+n 05.45.df keywords zipf's law income distribution The buyback will automatically be taxed as a cgt event not an income distribution if a number of conditions are fulfilled (advance clearance can be sought from hmrc).

Situs ini adalah komunitas terbuka bagi pengguna untuk berbagi apa yang mereka cari di internet, semua konten atau gambar di situs web ini hanya untuk penggunaan pribadi, sangat dilarang untuk menggunakan artikel ini untuk tujuan komersial, jika Anda adalah penulisnya dan menemukan gambar ini dibagikan tanpa izin Anda, silakan ajukan laporan DMCA kepada Kami.

Jika Anda menemukan situs ini bagus, tolong dukung kami dengan membagikan postingan ini ke akun media sosial seperti Facebook, Instagram dan sebagainya atau bisa juga save halaman blog ini dengan judul companies income distribution dengan menggunakan Ctrl + D untuk perangkat laptop dengan sistem operasi Windows atau Command + D untuk laptop dengan sistem operasi Apple. Jika Anda menggunakan smartphone, Anda juga dapat menggunakan menu laci dari browser yang Anda gunakan. Baik itu sistem operasi Windows, Mac, iOS, atau Android, Anda tetap dapat menandai situs web ini.